DaVita Inc.

DaVita Inc. (DaVita), formerly DaVita Healthcare Partners Inc, is a provider of dialysis services and integrated healthcare delivery and management services.

The company caters to patients with chronic kidney failure and end-stage renal disease (ESRD). The company has a 37% market share in the U.S. dialysis market.

The name ‘DaVita” was derived from the Italian language meaning “giving life”

Employees: 70,000

Revenue: $11.61B for FY2022

HQ Location: Denver, Colorado, United States

What they do:

They provide kidney dialysis services through a network of 2,816 outpatient dialysis centers in the United States, serving 204,200 patients, and 321 outpatient dialysis centers in 10 countries serving 3,200 patients.

The company primarily treats end-stage renal disease (ESRD), which requires patients to undergo dialysis 3 times per week for the rest of their lives unless they receive a donor's kidney.

Their vision and priorities:

To provide the greatest healthcare community the world has ever seen.

‘ We are dedicated to innovating patient care to improve our patients’ lives; to honoring and supporting our teammates, physician partners, and their families, and to nurturing the neighborhoods of our growing community’

Javier J. Rodriguez - CEO

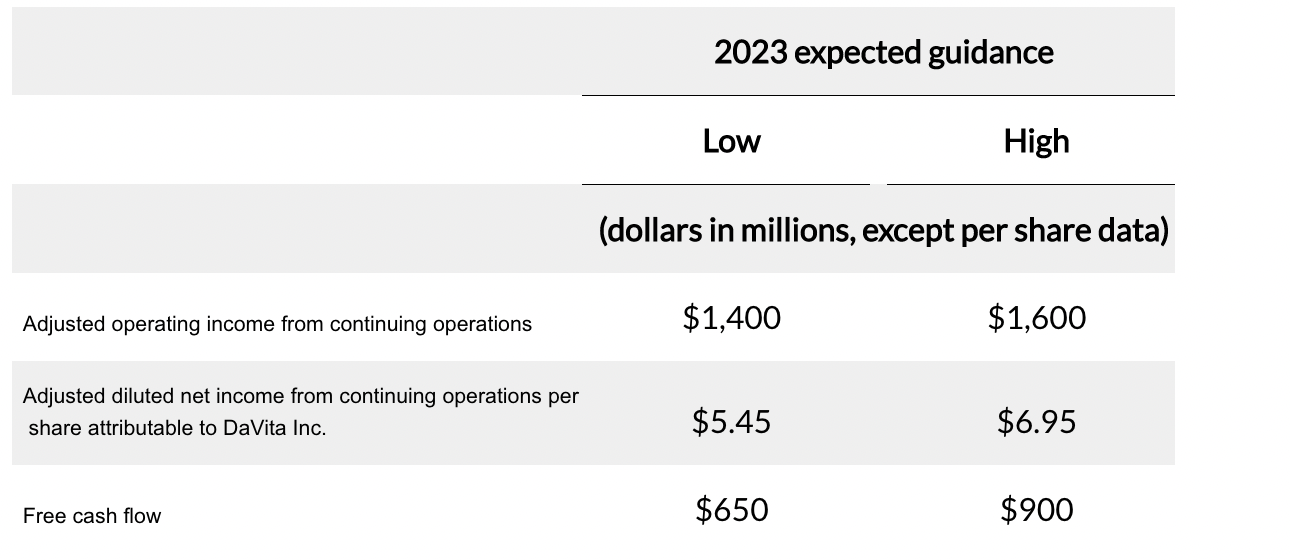

Financial and Capital Market Goals

Reduce center closures as Covid rates decline

Decrease patient care costs

Adjusted earnings per share of $6.20 - $6.70

Increase patient demand

Revenue per treatment outlook: 0.5% - 1.5%

Outlook for 2023

Competitors

CityMD

One Medical

Paladina Health

Things to know right now

2023 Priorities

Innovation

They are deploying their next-generation clinical IT platform. This new cloud-based system is designed to provide seamless access to patient records across locations, supporting integrated kidney care and enhancing data reporting and analytics.

Policy

The Kidney Care community remains actively working with CMMI to enhance innovative models that improve care coordination and advanced initiatives around transplant, home, and health equity. At the same time, they’re advocating for an update to the industry bundle payment system to better reflect year-over-year cost increases

Operationally

They remain committed to educating their patient, and their position to increase the adoption of home modalities were clinically appropriate. In support of their over 1,700 existing home programs, they are launching transitional care programs across the country to educate new dialysis patients on their modality options. They are also working toward full integration of their technology platform to create a holistic informational ecosystem for better home patient management.

Integrated Kidney Care

Business is expected to deliver another year of significant patient growth. With the benefit of increased scale, it will be an important year for them to continue building on their capabilities for IKC to achieve its purpose of driving better outcomes for their patients, better collaborations with physicians, and an economic alignment with their payer partners, particularly within the growing Medicare Advantage segment.

Cost Structure

To fuel these initiatives, they are maintaining a disciplined approach with their cost structure. For example, this includes their ongoing transition to ESA therapy and the ongoing consolidation of their facilities footprint to align capacity with treatment volumes.

What does each business unit do?

U.S. Dialysis Business

This part of the business offers dialysis services to patients suffering from end-stage renal disease by offering treatment options such as:

Kidney transplants - the transplanting of a donor's kidney into the patient’s body. A shortage of donors, the side effects of immunosuppressive medication, and the dangers associated with this type of treatment mean this treatment is not always an option even though it is the most desirable by most patients.

Hemodialysis (using an artificial kidney to remove toxins, fluids, and salt from the patient’s blood). This can be done in the patient’s home or at an outpatient treatment center.

Peritoneal dialysis (using the patient’s peritoneal or abdominal cavity to remove toxins and fluid). Performed in the patient’s home.

U.S. Dialysis Services

Outpatient hemodialysis services - a nephrologist is contracted to a dialysis center together with registered nurses, care technicians, social workers, dieticians, biomedical technicians, admin, and supportive staff to provide a medical service in each dialysis center.

Hospital inpatient hemodialysis services - hospital requested service based on a contracted per treatment fee with each hospital. When treatment is requested they provide dialysis treatment at the patient’s bedside or in a dedicated treatment room at a hospital.

Home-based dialysis services - this includes home hemodialysis and peritoneal dialysis. In these instances, patients preferring this kind of treatment at home are provided with the equipment, supplies, training, and mentoring and as well as on-call support and follow-up assistance where needed.

ESKD Laboratory services - this is a specialized automated clinical laboratory that specializes in ESKD patient testing. These tests are used to monitor a patient’s ESKD condition and any other medical conditions they might have.

Management services - providing a management service to 57 outpatient dialysis centers around the US.

Their financial calendar

Q1: February - April - Earnings May 5th

Q2: May -July - Earnings August 1st

Q3: July-September - Earnings 28th October

Q4: November -January - 23 February 2024

Next Earnings Report:

Around 5th May 2023

Positives from the last earnings report Q4FY22:

Consolidated revenues were $2.917 billion

Operating income was $256 million and adjusted operating income was $317 million

Centre Activity: They opened a total of six new dialysis centers and closed 58 dialysis centers in the United States. They also acquired three dialysis centers, opened three dialysis centers and closed eight dialysis centers outside of the United States.

Challenges from the last earnings report Q4FY22:

Their fourth quarter charges for U.S. dialysis center closures were approximately $35 million, which increased their patient care costs by $6 million, their general and administrative expenses by $5 million and their depreciation and amortization expense by $24 million

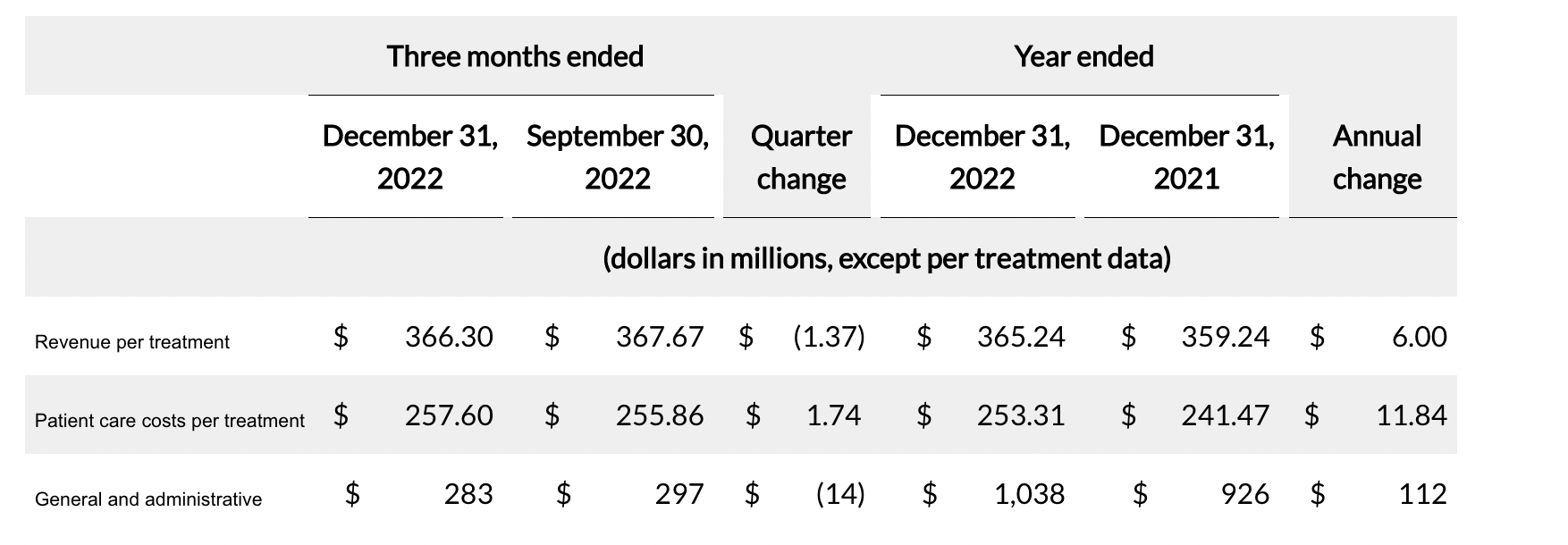

U.S. Dialysis Metrics:

Volume: Total U.S. dialysis treatments for the fourth quarter of 2022 were 7,239,660, or an average of 91,641 treatments per day, representing a per day decrease of (1.3)% compared to the third quarter of 2022.

Revenue: The quarter change was primarily due to non-recurring favorable adjustments in the third quarter. These changes were partially offset by increased hospital inpatient dialysis revenues, favorable changes in government rate driven by administration of influenza vaccines, favorable changes in commercial mix and the continued migration to Medicare Advantage plans

Patient care costs: The quarter change was primarily due to an increased other direct operating expenses associated with their dialysis centers, including increases in utilities expense partially due to lower expense in the third quarter related to thier virtual power purchase arrangements. Other drivers of the increase include increases in health benefit expenses, pharmaceutical costs and professional fees

Positives from FY22:

Consolidated revenues were $11.610 billion

Operating income was $1,339 million and adjusted operating income was $1,450 million

Centre Activity: They provided dialysis services to a total of approximately 245,000 patients at 3,074 outpatient dialysis centers, of which 2,724 centers were located in the United States and 350 centers were located in 11 countries outside of the United States.

Challenges from FY22:

Closure costs. During 2022, they incurred higher than normal charges for center capacity closures. These closures are the result of a strategic review of their outpatient clinic capacity requirements and utilization, which have been impacted both by declines in their patient census in some markets due to the COVID-19 pandemic, as well as by their initiatives toward, and advances in, increasing the proportion of their home dialysis patients.

For the year, charges for U.S. dialysis center closures were approximately $86 million, which increased their patient care costs by $21 million, their general and administrative expenses by $19 million, and their depreciation and amortization expense by $46 million.

U.S. Dialysis Metrics:

Revenue: The annual change was primarily driven by an increase in commercial mix and rate, an increase in the Medicare base rate in 2022 and the continued shift to Medicare Advantage plans, partially offset by the reinstatement of 1% Medicare sequestration

Patient Care Costs: The annual change was primarily due to increases in compensation expenses, other direct operating expenses associated with their dialysis centers, including increases in utilities expense, as well as closure costs, insurance expenses and costs related to travel. In addition, their fixed other direct operating expenses negatively impacted patient care costs per treatment due to decreased treatments in 2022